- In the upper right corner of the Payroll setup window, click on the Deductions/Benefits tab.

- To select a benefit/deduction, double click on the name of the benefit/deduction. An 'X' will appear to the left of the benefit/deduction. To de-select a benefit/deduction, double click on the benefit/deduction again. Only the deductions and benefits that are selected will apply to an employee's check.

-

After selecting a deduction or benefit, enter the amount of the benefit/deduction.

-

Deduction/Benefit Paid every Pay Period: Each deduction and benefit is per pay period,

not an annual figure. The benefit/deduction can be either before tax or after tax and can be

setup as either a fixed dollar amount or a percentage of the check.

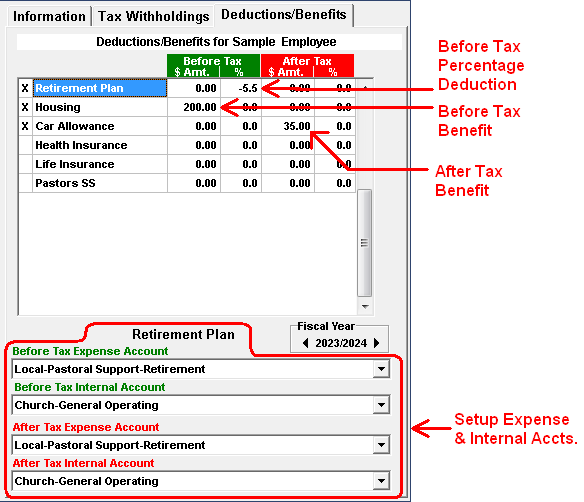

Example: In the example below, the Retirement Plan is a Before Tax payroll deduction of 8.5%. Notice that the percentage is negative. The Car Allowance is a Before Tax benefit of $35.00. Notice that the dollar amount is positive. You must enter deductions as negative amounts or percentages, and benefits as positive.

- Deduction/Benefit Paid Periodically: For any deduction or benefit that is not paid every pay period, set the amount/percentage to $0. When this deduction or benefit is paid, the amount will be entered onto the paycheck at the time it is generated. See How do I generate payroll checks? for further instructions.

-

Deduction/Benefit Paid every Pay Period: Each deduction and benefit is per pay period,

not an annual figure. The benefit/deduction can be either before tax or after tax and can be

setup as either a fixed dollar amount or a percentage of the check.

- Set the expense and internal account links for the benefit/deduction. In most cases, the expense account should correspond to benefit or deduction. The internal account will generally be the Church - General Operating. Be sure to set the accounts for the appropriate type, either Before or After Tax. See the illustration below.

- Repeat steps 2 through 5 for each benefit.

Each time a payroll check is generated, the expense and internal accounts will be charged for each benefit, and credited for each deduction.

If any of your deductions or benefits are subject to State Withholding Tax, please see Benefits subject to State Taxes for information on how to properly setup the deductions and benefits for state taxes.

For more information see: