There is no requirement to include a Pastor's salary on the 941 form if no Federal taxes have been withheld. If this is the case, and the Pastor is the only employee, then the 941 is not required to be filed.

However, if you want to include the Pastor on the 941 even though no Federal taxes have been withheld, then do the following:

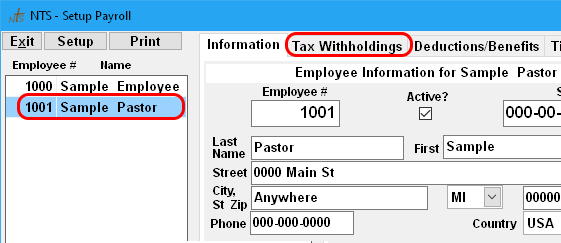

- Click SETUP from the Payroll screen

- Select the Pastor's name in the box on the left

- Click the TAX WITHHOLDINGS tab at the upper-right

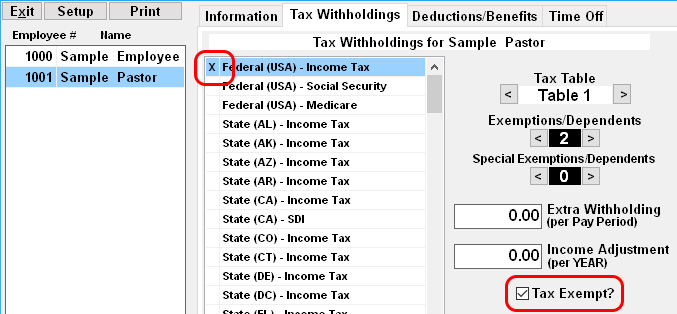

- Double-Click the left column next to FEDERAL(USA)-INCOME TAX. An "X" should appear.

- Click the TAX EXEMPT box. It should have a Checkmark in it.

The Pastor's salary will now be included on the 941 form - box 2, and they will also be included in box 1 when applicable.

- How does NTS report the Pastor's payroll on the 941 Form?

-

Church and Non-Profit Tax and Financial Guide

(By clicking on this link you will leave the NTS web site.) - Minister's Tax and Financial Guide

Disclaimer:

The information contained in this web page is of a general nature. It is not offered as

specific legal or tax "advice." Each person, local church, and district should evaluate their

own unique situation in consultation with their local legal and tax advisors. We are not

responsible for the accuracy of information on other web sites including sites linked to from

this page.