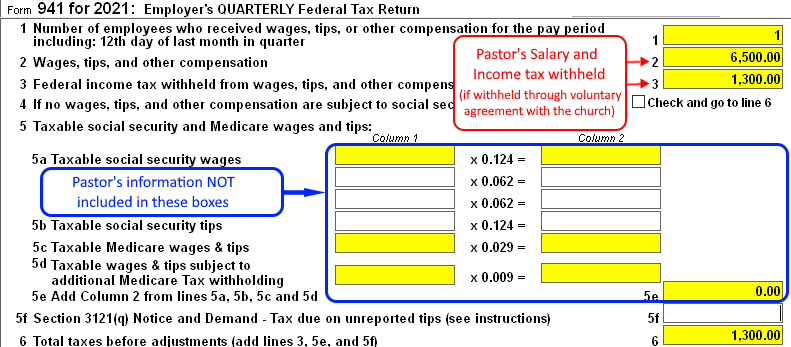

There is no requirement to include a Pastor's salary on the 941 form if no Federal taxes have been withheld. If this is the case, and the Pastor is the only employee, then the 941 is not required to be filed.

If Federal income tax has been withheld through a voluntary agreement with the church, then the Pastor's salary would be reported along with the other employees on box 2 of the 941 and the Pastor's Federal income tax withheld would be reported on box 3 along with the other employees. The Pastor's salary would NOT be reported on boxes 5a-e since Pastors SHOULD NOT have Social Security or Medicare taxes withheld/paid. Only non-ministerial employees' salaries should be reported on these lines.

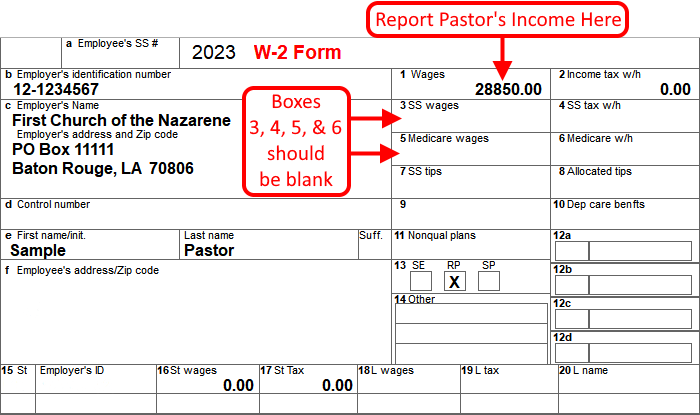

The Pastor should ALWAYS receive a W-2 form from the church each year. The Pastor's income should be reported in box 1 and any Federal income tax withheld should be reported in box 2. Boxes 3-6 should be blank since Pastors SHOULD NOT have Social Security or Medicare taxes withheld.

Your pastor's tax situation may be different and/or unique. Contact a local tax advisor or your district office if you need further assistance with how to report your pastor's salary or if you are unsure of your pastor's tax situation. The links below also have good information.

- How to include Pastor on 941 Form (even when taxes are not withheld)

-

Church and Non-Profit Tax and Financial Guide

(By clicking on this link you will leave the NTS web site.) - Minister's Tax and Financial Guide

Disclaimer:

The information contained in this web page is of a general nature. It is not offered as

specific legal or tax "advice." Each person, local church, and district should evaluate their

own unique situation in consultation with their local legal and tax advisors. We are not

responsible for the accuracy of information on other web sites including sites linked to from

this page.