The Payroll Report shows a listing of each payroll check issued. The report shows the check date, pay period, pay type (salary, hourly, etc), pay check frequency, total gross salary, total before tax deductions/benefits, total taxes and total after tax deductions/benefits for each check. When a check is selected, the specific details of the benefits and deduction along with individual tax withholdings are listed at the bottom of the screen.

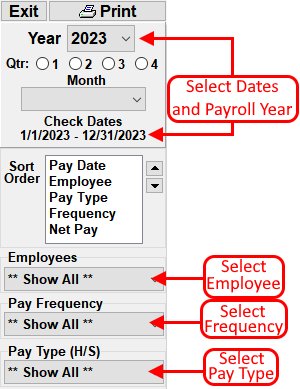

The report has filters available that can be used to customize the report:

Sort Order - The report can be sorted by Pay Date, Employee, Pay Type, Pay Check

Frequency and Net Pay amount. By default, the report is ordered by this criteria in the order

listed here. To change the order, click on one of the criteria and then click the

or

or  buttons.

buttons.

Paycheck Dates / Payroll Year - Set the Paycheck Dates to the range of dates for the paychecks you want to include on the report. Select a specific quarter by simply clicking the corresponding quarter button below the paycheck date range. Set the Payroll Year to the appropriate year or select Show All Years to view checks from more than one calendar year.

Employees - To view checks for a specific employee, select the employee's name from the employee list.

Pay Frequency - Select a pay frequency to view checks for employees that are paid on a specific time frame; ie., weekly, monthly, etc.

Pay Type - Select a pay type to view checks for employees that are hourly, salary, contract or other.

To print the report, click the Print button at the top of the screen.