The Payroll Summary report will provide all of these totals.

- From the Payroll Screen, click on Reports and then Summary Report.

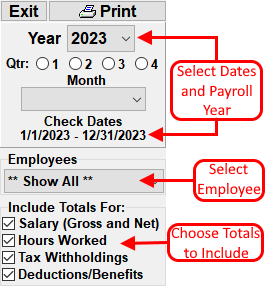

- The report will automatically calculate totals for the current payroll year. To choose a smaller date range, click on the Start or End dates to change the report range. Optionally, click one of the quarter buttons (1, 2, 3 or 4) to set the date range to that quarter.

- To look at a different payroll year, change the payroll year by clicking one of the arrows on either side of the Payroll year.

- To view totals for a single employee, choose the employee from the Employee Name list.

- It is possible to select which totals are included on the report by un-checking any of the Totals Options. Example: If you do not wish to view totals for the number of hours worked, uncheck the Hours Worked box. To only view totals for Tax Withholdings, uncheck all the Totals options except for Tax Withholdings.

- To print the report, click the Print Report button at the top of the screen.