This situation is usually caused by one of two problems. First, the tax withholdings may not be setup correctly or the tax withholdings are set up in such a way that the amount of taxes withheld equals $0.00.

Check to see that the employee is set up to have taxes withheld:

- From the payroll screen, click on the Setup button.

- Select the employee for which the taxes are not being withheld in the employee list on the left side of the screen.

-

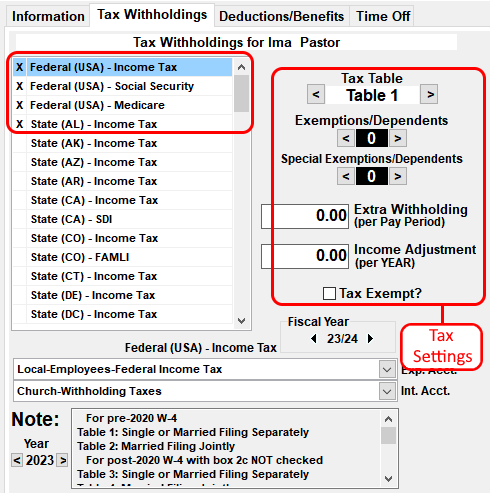

Click on the "Tax Withholdings" tab at the top on the right side of the window.

Only taxes that have an 'X' to the right of the name of the tax will be withheld for this employee. See the picture below for an example. In this example, Federal Income Tax, Medicare, FICA, and Alabama State Taxes are being withheld.If the taxes are selected but the amount being withheld is $0.00, check the tax settings for each individual tax. To view the settings for a specific tax, click on the tax in the list of taxes. The settings for that specific tax will be shown to the right of the tax list (see the illustration below):

- Verify the number of exemptions for each tax. Look at the number of deductions on the right side of the window. A high number of deductions could prevent any taxes from being withheld from the employee's check.

- Check the Tax Table setting for each tax. Verify that the correct table is selected. The Note at the bottom of the window will give information about which tax table should be used.

- Check to see if the Tax Exempt box is checked. If this box is checked, then no amount will be withheld for this tax.

For more information see: