This is typically the result of one of two different situations. Either it is time to change the fiscal year to the next year or the fiscal year start/end dates have been set incorrectly.

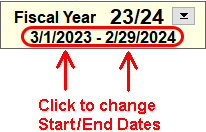

The fiscal year start/end dates can be found in the upper left corner of the Checkbook screen. (If you have NTS version 4.40 or before, click the Fiscal Year button at the top of the screen to view the start/end dates.) See the examples below.

New Fiscal Year

NTS will not allow you to enter dates that are outside the fiscal year. If your fiscal year ends on April 30 and you are trying to enter a transaction for May 1, then you need to start the next fiscal year. For instructions on starting a new fiscal year, see the link below.

Incorrect Fiscal Year Dates

- Verify that the fiscal year start and end dates are correct. The start and end dates should represent the start and end dates of the fiscal year. For example: If your fiscal year begins May 1, then the start and end dates would be May 1, and April 30, respectively.

- If the start or end date is incorrect, click on the incorrect date and a calendar will open.

- Choose the correct date from the calendar and click OK.

Once the fiscal year start and end dates have been set, you should never to change these dates. The only exception would be if your district changed the fiscal year start or end dates. If you need a report or contribution receipt with a different date range, it is always possible to change the date range on the report or receipt without changing the fiscal year dates. If you need assistance with this, please contact us.