There are 2 different scenarios that could occur. Scenario #1: The credit only partially covers or pays for the new invoice. Scenario #2: The credit completely pays for the new invoice.

Scenario #1

In this case, a check will be written for the difference between the credit and the new invoice.

- Post a check for the amount needed to pay off the account balance. The check amount will be the amount of the new charges minus the credit.

- On the check detail, list the full amounts for the new charges on the invoice.

- Add a line for the credit amount. Select the expense account and internal account for the credited amount. These accounts would be the same accounts used on the check that was originally written to pay for the expenses. The amount on the credit line will be a negative amount. See the example below.

Scenario #2

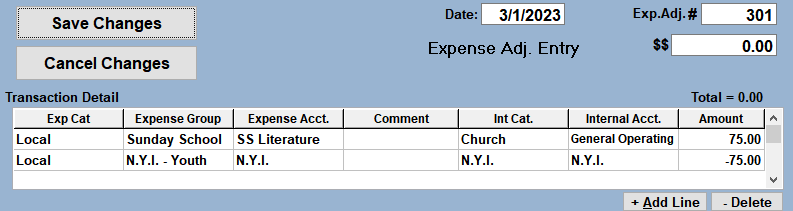

In this case, post an expense adjustment to credit the original expense and charge the new expense to the correct expense account.

- Start a new expense adjustment.

- The total amount of the adjustment will be $0.00. Enter zero into the "$$" box.

- On the first line of the transaction detail, choose the expense and internal account that you want to credit the money back to. These accounts should be the same accounts as on the original check to pay for the charges. In the amount box, enter a positive amount to credit the money back to the account.

- >The add additional line(s) to the adjustment for the new or current charges. Choose the expense and internal accounts for the new expense just like a check. In the amount box, enter a negative amount to charge the amount to the correct account. See the example below.