To handle Uncleared/Unreconciled Transactions that have been lost, were erroneously posted or will never clear:

- Select the fiscal year that has the Unreconciled Transactions.

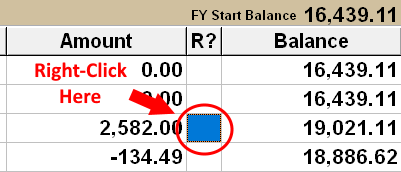

- Right click on the R? column of any transaction on the Bank Transaction Register.

This will move all Unreconciled Transactions to the top of the list.

- Do 1 of the following:

- Delete the UnReconciled transactions.

- OR Edit each UnReconciled transaction and change the AMOUNT to $0.00.

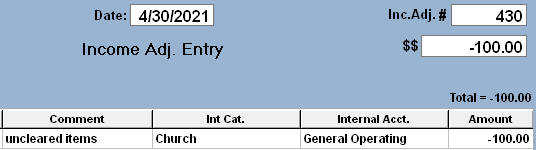

- OR Post an Income Adjustment dated the last day of that Fiscal Year for the OPPOSITE $ Amount of the

TOTAL of the UnReconciled Items.

In the Example above, the Total of the 2 UnReconciled items is -544.75 (-650.00+105.25), so the Adjustment Amount needed to offset would be a Positive 544.75. Post to the Church/General Operations Internal Account.

- Update the Starting Balances in ALL subsequent Fiscal Years to match the Previous Year Ending Balances:

Select the next Fiscal Year, then Click Here for Instructions to Update Starting Balance.