If ending a Fiscal Year with a CREDIT in an Expense Account, then you may optionally carry that credit into the new Fiscal Year, but this is not required.

To carry the credit forward, two Expense Adjustment entries will need to be posted:

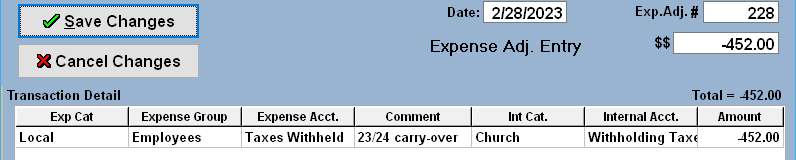

In this example, $452.00 of Taxes have been withheld from Employee's paychecks but not yet paid to

the applicable authorities. The Expense Account "Taxes Withheld" is ending the year with this credit.

-

Post an Expense Adjustment in the current fiscal year. Make sure that the Amount is NEGATIVE.

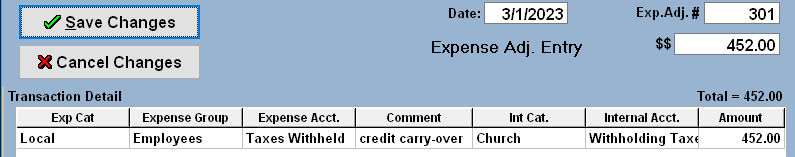

In this example, the Fiscal Year ends on 2/28. - After starting the new Fiscal Year, Post an Expense Adjustment using a POSITIVE Amount.