The only difference between an In/Out and a normal transaction is the deposit. When depositing money for an In/Out transaction, it must be marked as Expense Credit.

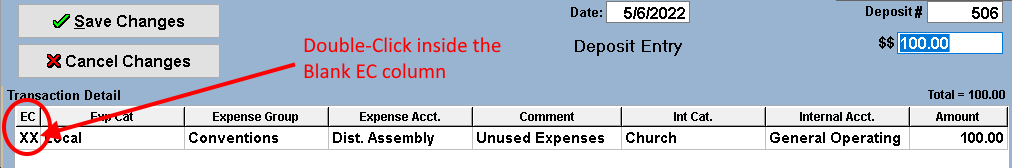

- Open a new deposit entry. In the transaction detail portion of the deposit, the left most column is labeled EC, which stands for expense credit. Double click inside the box and 'XX' will appear.

- Select the expense account that will be used when writing the check for the In/Out transaction. In many cases, this would be the In/Out expense account, but it doesn't have to be. Any expense account can be used even if it is not specifically designated as an In/Out account.

- Fill out the remainder of the deposit as you normally would. See the illustration below.

- When writing the check for the expense, select the same expense and internal accounts as was on the deposit. This will cause the transaction to be a wash so that it not show up on your Annual Report.

On In/Out transactions, any expense or internal account can be used. The important thing is to make sure the same accounts (both expense and internal accounts) are used on the deposit and the check.

Refund checks should be deposited in the same manner. The expense account should be the same account as on the original check. For example, a rebate is received on the purchase of a new computer. The Church - Office Supplies expense account was charged when the computer was purchased. Select the Church - Office Supplies account on the deposit for the refund check.

In/Out transactions may occur over several transactions. For example, a check might be written for the entire amount, but money could be received over several weeks or months. The deposit and/or check does not have to be for the full amount. You can write multiple checks and make only one deposit or vice versa.

NOTE : Only mark a deposit as an expense credit if the money is specifically In and Out money. Normal deposits for things such as Sunday tithes or designated offerings such as faith promise or building fund should NOT be marked as an expense credit.